“GST Act Rules and Rugulations (as amended by Finance Act, 2023)” has been added to your cart. View cart

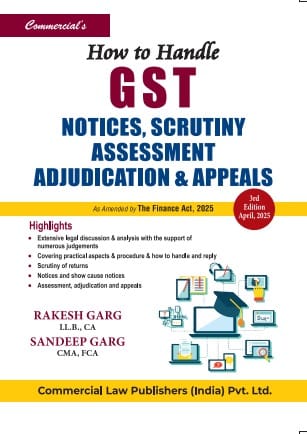

How to Handle GST Notices Scrutiny Assessment and Adjudication As Amended by Finance Act 2025

₹1,495.00 Original price was: ₹1,495.00.₹1,120.00Current price is: ₹1,120.00.

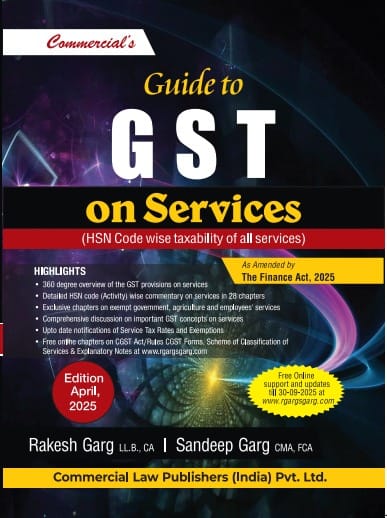

| Author: Rakesh Garg, Sandep Garg | Language: English |

| Edition: Latest | Binding/Format: Paperback |

| Publishing Year: 2025 | Publisher: Commercial Law Publishers |

Your order qualifies for free shipping!

In stock

24

People watching this product now!

Description

Extensive Legal Discussion and analysis with the support of Numerous Judgements

Covering Practical aspects and procedure and how to handle and reply

Scrutiny of Returns

Notices and Show Couse Notices

Assessment Adjudication and Appeals

Additional information

| Weight | 1 kg |

|---|---|

| Dimensions | 18 × 6 × 24 cm |

Rated 0 out of 5

0 reviews

Rated 5 out of 5

0

Rated 4 out of 5

0

Rated 3 out of 5

0

Rated 2 out of 5

0

Rated 1 out of 5

0

Be the first to review “How to Handle GST Notices Scrutiny Assessment and Adjudication As Amended by Finance Act 2025”

You must be logged in to post a review.

Reviews

Clear filtersThere are no reviews yet.