“Direct Taxes Law and Practice with Special Reference to Tax Planning” has been added to your cart. View cart

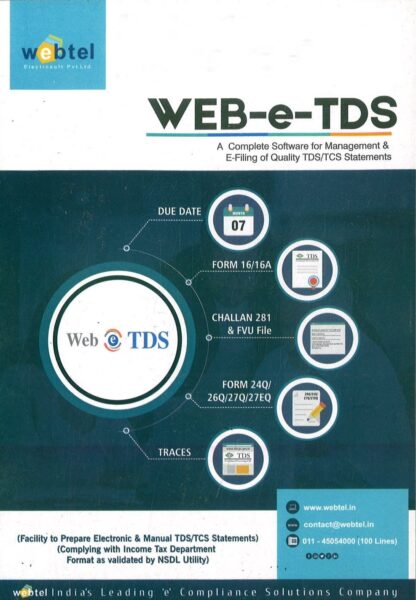

Webtel E-TDS Software for F.Y. 2025-26

₹3,720.00 – ₹7,400.00Price range: ₹3,720.00 through ₹7,400.00

Form 24Q, 26Q, 27Q, 27EQ: e-Return & Paper Return.

Original & Revised TDS / TCS Statements

Generation of e-TDS / e-TCS Return Through Excel Utility in case of Bulk Data.

Online TAN Registration at TRACES / TRACES Dashboard

Download / Generate Form 16, 12BA, 12BB, Quarterly 16A & 27D.

Multi-user option available.

Your order qualifies for free shipping!

31

People watching this product now!

Description

Form 24Q, 26Q, 27Q, 27EQ: e-Return & Paper Return.

Original & Revised TDS / TCS Statements

Generation of e-TDS / e-TCS Return Through Excel Utility in case of Bulk Data.

Online TAN Registration at TRACES / TRACES Dashboard

Download / Generate Form 16, 12BA, 12BB, Quarterly 16A & 27D.

Multi-user option available.

Additional information

| Users |

Single User ,2 User ,5 User |

|---|

Related Products

MSME Ready Reckoner

Direct Taxes Law and Practice with Special Reference to Tax Planning

Handbook on TAX DEDUCTION AT SOURCE

Income Tax Assessment of Trade Specific Sectors As Amended by The Finance Act 2025 by Ram Dutt Sharma

Handling of Income Tax Problems As Amended by The Finance Act 2025 by Ram Dutt Sharma

Income Tax Guidelines & Mini Ready Reckoner with Tax Planning 2025-26 and 2026-27

???? ???????? & Mini Ready Reckoner ??? ??? ????? ???????? 2025-26, 2026-27

-20%

Select options

This product has multiple variants. The options may be chosen on the product page

Taxmann E-TDS Software F.Y. 2025-26

₹6,800.00 – ₹9,400.00Price range: ₹6,800.00 through ₹9,400.00-25%

Select options

This product has multiple variants. The options may be chosen on the product page

Direct Taxes Manual in 3 Volumes

₹7,895.00Original price was: ₹7,895.00.₹5,525.00Current price is: ₹5,525.00.