“FORMATION MANAGEMENT AND TAXATION OF CHARITABLE AND RELIGIOUS TRUST AND INSTITUTIONS UNDER INCOME TAX LAW AMENDED BY FINANCE ACT 2025 by RAM DUTT SHARMA” has been added to your cart. View cart

“FORMATION MANAGEMENT AND TAXATION OF CHARITABLE AND RELIGIOUS TRUST AND INSTITUTIONS UNDER INCOME TAX LAW AMENDED BY FINANCE ACT 2025 by RAM DUTT SHARMA” has been added to your cart. View cart

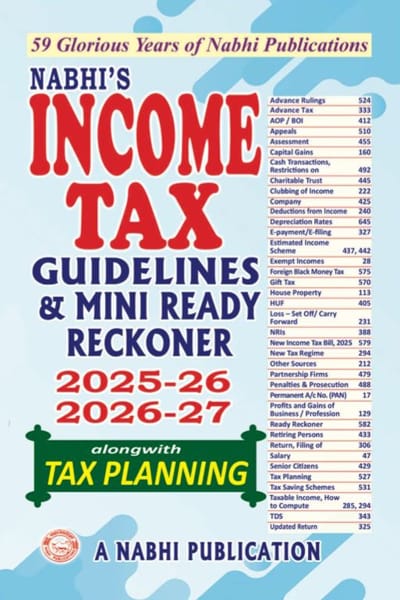

TAX PLANNING – PRACTICAL ASPECTS

₹1,295.00 Original price was: ₹1,295.00.₹970.00Current price is: ₹970.00.

| Author: Chunauti H Dholakia | Language: English |

| Edition: 2nd | Binding/Format: Hardbound |

| Publishing Year: 2025 | Publisher: Bharat Law House |

Your order qualifies for free shipping!

In stock

118

People watching this product now!

Description

Chapter 1 Introduction of Tax Planning

Chapter 2 Overview of Income Tax System in India

Chapter 3 Tax Planning for Salaried Persons

Chapter 4 Tax Planning for Businessmen and Professionals

Chapter 5 Tax Planning for HUF, Partnership Firm and Will

Chapter 6 Tax Planning for Real Estate Transactions

Chapter 7 Tax Planning for Financial Asset

Chapter 8 Tax Planning for Non Residents

Chapter 9 Tax Planning for Companies

Chapter 10 Tax Planning for Trusts and Co-operative Societies

Chapter 11 New Tax Regime

Additional information

| Weight | 1 kg |

|---|---|

| Dimensions | 18 × 6 × 24 cm |

Rated 0 out of 5

0 reviews

Rated 5 out of 5

0

Rated 4 out of 5

0

Rated 3 out of 5

0

Rated 2 out of 5

0

Rated 1 out of 5

0

Be the first to review “TAX PLANNING – PRACTICAL ASPECTS”

You must be logged in to post a review.

Reviews

Clear filtersThere are no reviews yet.