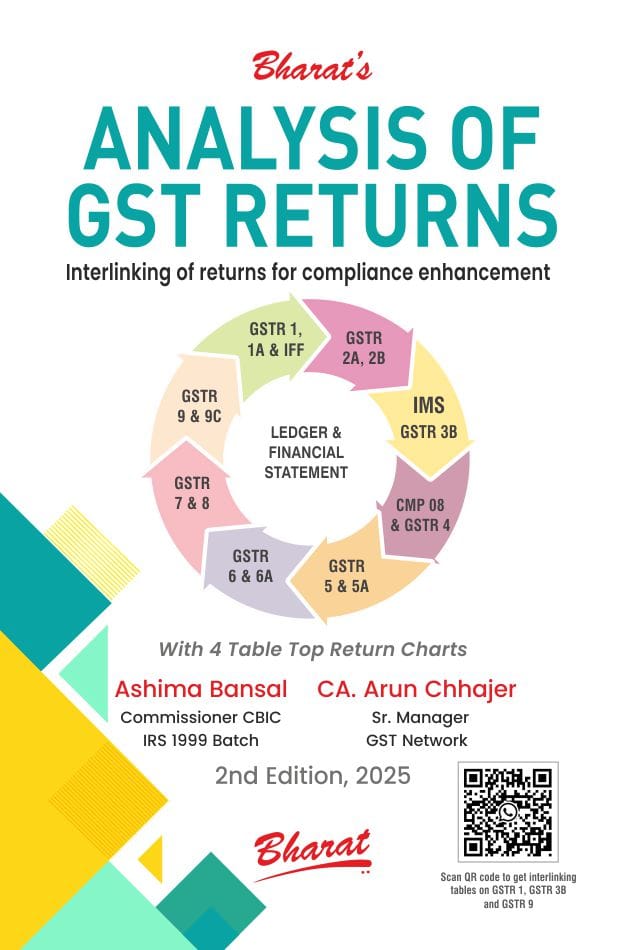

ANALYSIS OF G S T RETURNS

₹1,195.00 Original price was: ₹1,195.00.₹896.00Current price is: ₹896.00.

| Author: ASHIMA BANSAL and CA ARUN CHHAJER | ISBN: 978-81-9776-648-0 |

| Edition: 2nd | Binding/Format:Paperback |

| Year: 2025 | Weight: 1000 Grams |

| Language: English | Publisher: Bharat Law House |

In stock

Chapter 1 Overview of GST Return

Chapter 2 Analysis of GSTR 1 and its Interlinking with GSTR 3B, 9 and 9C

Chapter 3 Analysis of GSTR-1A

Chapter 4 Invoice Management System

Chapter 5 GSTR 2A and GSTR 2B

Chapter 6 GSTR 3B and its interlinking with GSTR 1/9/9C

Annexure 1 Due Date Chart for GSTR 3B from July 2017 to December 2024

Chapter 7 Analysis of GSTR 9 and its Interlinking with GSTR 3B, 1 and 9C

Chapter 8 Analysis of GSTR 9C and its interlinking with GSTR 1, 3B and 9

Chapter 9 CMP-08 and GSTR 4 [Composition Levy Scheme]

Chapter 10 GSTR 5 (Non-Resident Taxpayer)

Chapter 11 GSTR 5A (OIDAR and Online Money gaming)

Chapter 12 GSTR 6 and 6A (Input Service Distributor)

Chapter 13 GSTR 7 and GSTR 7A (Tax Deduction at Source)

Chapter 14 GSTR 8 (TCS by ECO)

Chapter 15 Ledgers, Statements and Reports

Chapter 16 Explore the Financial Position: Understanding the P&L, Balance Sheet and Ratio Analysis

Chapter 17 Review of Financial Statements

| Weight | 1000 g |

|---|---|

| Dimensions | 18 × 6 × 24 cm |

You must be logged in to post a review.

Reviews

Clear filtersThere are no reviews yet.